Funded by the Bill & Melinda Gates Foundation, HFP was a three-year, multi-country contract to test and explore innovations in the field of housing finance for the poor. Through action research, the program endeavored to provide donors, policy makers, and development finance practitioners with a tangible and comprehensive blueprint for prioritizing future investments and efforts toward the promotion of housing finance globally. DIG developed and tested groundbreaking housing finance products and approaches for servicing poor individuals in a variety of development contexts through partnerships with more than a dozen institutions (including MFIs, microfinance banks, commercial banks, and apex institutions).

Through HFP, DIG developed and tested numerous housing finance products, services, and methodologies including but not limited to:

- Mortgage products targeting the poor

- Varying approaches to housing microfinance

- Housing finance subsidies for the poor

- A credit scoring model for housing finance

- Housing finance in conjunction with slum improvement

- Housing finance in post-emergency settings

- Technological innovations related to housing microfinance

Through our comparative analysis of HFP activities in India, Pakistan, Indonesia, South Africa, Morocco, Angola, and Mexico, we assessed key products and potential markets for housing finance for the poor, and conditions needed to enhance its scale and sustainability. To better understand the contexts in which these markets operate, DIG also conducted research on policies and regulations impacting access to housing finance for the poor.

Over the course of the HFP program, DIG provided extensive technical assistance and training to 230 financial institutions. Notable successes included: providing extensive technical assistance and training to commercial banks and service companies to design and deliver housing finance products for the poor – both as asset-building and consumption loans; assisting housing microfinance institutions working to achieve scale; linking housing finance to subsidy products; developing innovative financial tools for slum improvement; and launching an on-line community of practice website ( www.housingfinanceforthepoor.com) to disseminate program findings and serve as a platform for knowledge sharing among partners, donors, and practitioners.

Related Projects

- Accountable Democratic Action (ADA) through Social Cohesion

- Anti-Money Laundering And Combating The Financing Of Terrorism (AML/CFT) Requirements

- Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) Sector Reviews

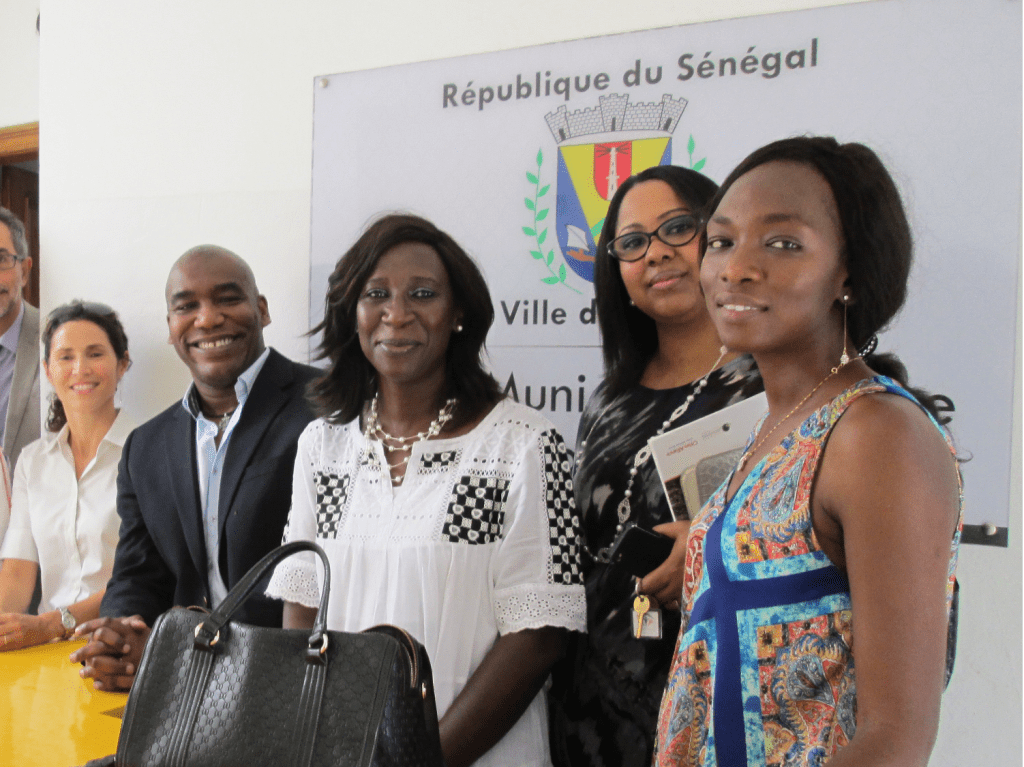

- Dakar Municipal Finance Program

- ECAP I & II – Emergency Capacity Assistance Program

- EMKAN Support – Microfinance Technical Assistance

- Global Program for Inclusive Municipal Governance (GPIMG)

- Haiti Rebati Facility

- Housing Finance for the Poor (HFP)

- Kenya Integrated Water, Sanitation, and Hygiene Project (KIWASH)

- Microfinance Training of Trainers (TOT) for USAID-Iraq

- Microfinance Training of Trainers for USAID-Iraq (IZDIHAR)

- Southern Agriculture and Business Recovery (SABR)

- Sustainable Water and Sanitation in Africa (SUWASA)